Probate Practitioners and Personal Representatives are continuing to experience long delays at the Probate Registry causing great inconvenience for Executors and Beneficiaries alike.

The turnaround for a Grant of Probate has usually been two-three weeks, but recent government changes have meant that applications for a Grant are taking from three to six months to be processed, with thousands of applications still pending.

There are a number of reasons causing the delay and some of these reasons, along with the current impact are detailed below:

Since 1999 applications have been subject to a fixed fee for applying for a Grant. Currently if the net amount passing under the Grant is over £5,000 there is a set probate fee of £215.00 for personal applications or £155.00 where the application is being made by a Solicitor.

The new proposal, which the Government announced in November 2018 was due to be implemented in April 2019, however the recent Brexit turmoil meant the necessary legislation has not yet been laid before Parliament.

Soon after the announcement that the new probate fees would be delayed was made, Probate Registries confirmed they would accept applications for probate with the current reduced fee where the account had already been submitted to HMRC, but before the account has been processed by HMRC. The application must include a note to say that the appropriate Inheritance Tax forms will follow shortly. This has inevitably caused a significant delay in matters dealt with by HMRC i.e tax rebates etc.

Given the uncertainty of when the new fees will be implements, there has been a surge of probate applications being submitted ahead of this planned increase, ultimately adding to the vast backlog.

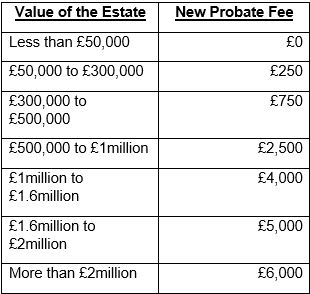

The new proposals mean that there will be a banded structure.

Estates with less than £50,000 passing under the Grant will pay no fee, however estates worth more than £50,000 will pay higher fees of up to £6,000 depending on the size of the estate. This fee is payable on top of any Inheritance Tax that also may be due.

Below is the new probate fee structure.

With the new fees being implemented soon there is a concern on how this is going to affect people making probate applications. One of the concerns is that it may put people off making an application or not disclose full details of assets in the application in order to pay a reduced fee.

Estates are taking longer to administer as the Grants are taking up to six months to be issued which is meaning beneficiaries are having to wait longer to receive their entitlements.

House sales are delayed and in some cases are falling through as a Grant is required in order to sell a property.

Creditors are having to wait longer to be paid.

The Probate Registry have implemented a new system for online probate applications to try and tackle the backlog. However, IT systems will come with the usual IT glitches which is also having an impact on the delay of applications.

Whilst the prospect of the new probate fees seems daunting, structures such as Will Trusts can be used to help reduce the value of an estate for Inheritance Tax purposes, meaning that a lower probate fee charge will apply.

The Wills, Trusts & Estates team here at DTM Legal would be happy to advise or talk you through potential estate planning ideas or any concerns you may have.