Recovery of rent and service charges under a commercial lease during COVID

Judgment was handed down by District Judge Johnson at the Liverpool County Court on 1st November 2021 in Atmore Centres Limited and Atmore Investments Limited v TFS Stores Limited in the Landlord’s summary judgment application relating to a landlord’s ability to recover rent and service charge under a commercial lease during the COVID-19 pandemic.

This follows the decision in Commerz Real Investmentgesellschaft mbH v TFS Stores Limited [2021] EWHC 863 (Ch) where the landlord sought the payment of rent and service charge due under a lease of retail premises at Westfield London. The tenant had paid no rent since April 2020, citing difficulties in affording the rent due to closures and lack of footfall caused by the COVID-19 pandemic.

The tenant contended that the landlord’s claim was premature because it had failed to engage with the Government’s Code of Practice for Commercial Property Relationships, that the landlord was seeking to circumvent measures put in place by the Government preventing forfeiture, winding up petitions and the Commercial Rent Arrears Recovery procedure. This is where rent arrears are related to Covid 19 and the Landlord failed to meet its obligations under the Leases. It was considered reasonable for the tenant to expect that the landlord would obtain satisfactory cover to include such other risks as may be necessary and/or required. And that this would include such other risks as may be necessary and/or required and that this would include cover for loss of rent and service charge related to forced closures and/or denial of loss of access due to notifiable disease and/or Government action.

On the day of the hearing the tenant sought to include a defence by claiming that on the proper construction of the Lease the rent suspension provisions include non-physical damage; the rent suspension provisions include restrictions on the tenant’s use of the premises; further or alternatively the rent suspension provisions apply upon occurrence of the risks and other contingencies against which the premises from time to time were or should have been insured under the Leases.

The Code of Practice expressly noted that it did not have the effect of varying or suspending the contractual terms of any commercial lease. In any event, it was simply not the case, on the evidence, that the landlord had failed to engage with the tenant as envisaged by the Code of Practice.

Whilst the Government had expressly suspended the ability of a landlord to exercise various legal rights, it had not altered the ability of a landlord to bring a claim for unpaid rent and service charge.

The tenant’s main argument concerned the landlord’s insurance for loss of rent against the occurrence of a notifiable disease. The landlord’s case was that the landlord’s insurance protected losses incurred by the landlord to its business. It was no part of the landlord’s obligation to insure for the landlord to insure against losses to the tenant’s business; it was open to the tenant to take out its own business interruption insurance to protect itself against such risks. The lease required the rent to be paid during the term.

The exception to that, set out in the rent cesser provisions, applied only where there was damage to the landlord’s premises. Here, there was no such damage. That meant that the rent continued to be payable under the lease. Any claim by the landlord under its policy would therefore be rejected by its insurer on the grounds that the landlord had not suffered a loss to its business. There was no justification for an argument that the landlord must look first to its insurance policy where the rent remained due under the terms of the lease.

The Court accepted the landlord’s case noting that, as a matter of construction of the lease, the damage referred to in the rent cesser provision only applied where there was physical damage to the property. There was no basis, the court noted, for construing that provision as to apply in the event of the premises being closed due to a legal requirement.

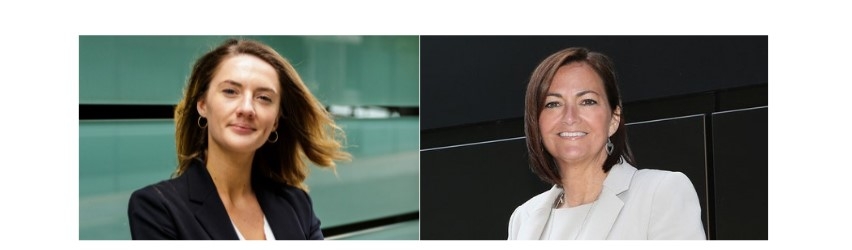

DTM’s team was led by Anna Duffy who was assisted by Imogen Gray. Anna Duffy instructed Gary Cowen QC from Falcon Chambers to act for the successful Claimant in this case. To contact Anna Duffy please email her at anna.duffy@dtmlegal.com